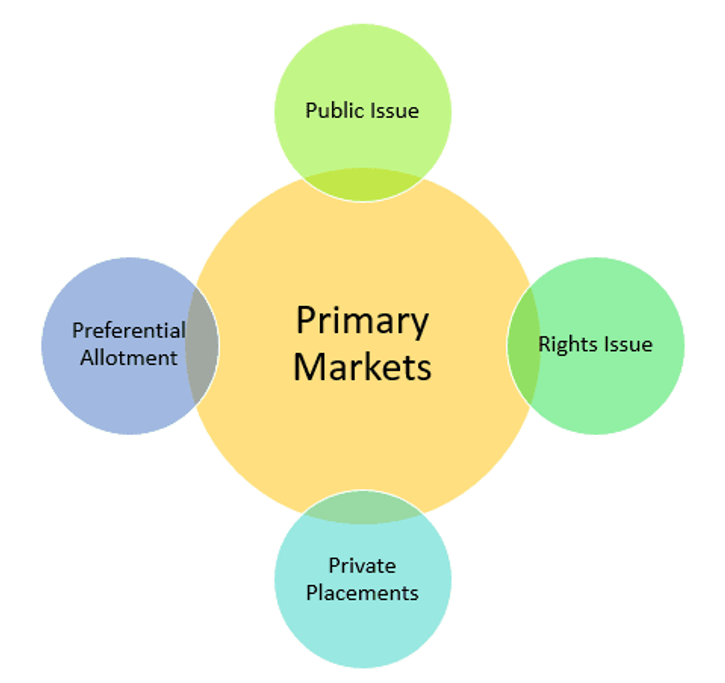

Primary Market

There is no such thing as Wall Street in the primary markets. Securities (such as bonds and stocks) are first created in the "primary market," where they are first traded. Rather, securities and bonds are traded publicly on this primary market. Unlike other markets, where investors buy and sell securities amongst themselves, here, investors purchase securities directly from banks that underwrite the initial public offering (IPO).

Primary Market Benefits

When comparing primary and secondary markets, neither one should be viewed as superior to the other. Investing success is more likely if you have a firm grasp of the advantages and disadvantages of the stock and bond markets, as well as how to navigate them. Here are a few of its distinct advantages for the primary market. Businesses can raise capital at a reasonable cost. Diversification is a great way to lower your risk of loss—a lack of market turbulence. The primary market is highly liquid because securities can be traded instantly. Investors from around the world could come to this market directly. It's possible to manipulate prices down.

Secondary market

Investors can trade across all major indexes, including the New York Stock Exchange, the NASDAQ S&P 500, and other major exchanges worldwide. Since securities are traded on the secondary market without involvement from the companies that issue them, this is an important distinction to keep in mind. Because of the secondary market's role as an exchange for new and first-time investors to trade securities, it is a source for purchasing bonds, stocks, and other financial instruments.

Secondary Market Benefits

Consider the distinct advantages of each financial space when comparing primary markets to secondary markets. The ability to open the market to new investors is the primary second market advantage. However, these aren't the only notable advantages provided by the market. Trading on the secondary market does not necessitate a large sum of money, making it more widely available. Investors can make a fortune in a matter of months. The stock price can easily be used to gauge the importance and performance of a company. Liquidity for investors is ensured by the ease with which stocks can be bought and sold. Consumers can learn about a company's financial standing in this market.

How Do Primary Markets Function?

Initial Public Offerings (IPOs) are a common way for new securities and stock to be sold to the general public (IPO). Sellers can hire financial groups, securities dealers, and investment bankers to examine security, its price, and other critical information. Trading in securities on the capital market is regulated and accepted by the Securities and Exchange Commission (SEC) and other securities regulatory agencies. On the primary needs, there is some degree of price volatility.

What Is The Role Of Secondary Markets?

The stock market, also known as the secondary capital market, is where previously owned stocks can be traded between investors. Instead of buying directly from the seller in the traditional capital markets, buyers can exchange their stores on secondary markets. IPOS investors do not have exclusive access to secondary capital markets; anyone can buy or sell securities there.

Examples of secondary markets include the New York Stock Exchange (NYSE), the London Stock Exchange, and the Nasdaq. On the secondary market, the amount of securities traded is determined by fluctuations in supply and demand, which can affect the price of a security, as opposed to the primary market, where companies wish to sell their stocks quickly to achieve the required volume.

Primary Markets VS. Secondary Markets

1. Meaning

When a company issues new security, the primary market is the first place it sells and offers protection to the general public. For the first time, investors can buy a company's stock. The secondary market is where newly issued securities are traded between individual investors.

2. Hierarchy

The term "primary market" refers to the initial stage of developing and selling equity and debt securities to investors. Put another way, securities made in the first market can be traded again in the secondary market.

3. Parties that Transact

In the primary market, the selling entity is the one issuing securities, while the buyers are the ones who purchase them. The company that issued the securities receives a large portion of the proceeds from this market. Sellers and buyers are both investors in the secondary market. They are investing in and out of securities accounts for most financial transactions.

Conclusion

There is a primary market where securities are produced and secondary markets where investors trade their stocks. First-time public offerings of new bonds and stock occur on this market, which is called the primary market (IPO). New York Stock Exchange, the Nasdaq, and other global stock exchanges are referred to as "secondary markets" in this context.