Introduction

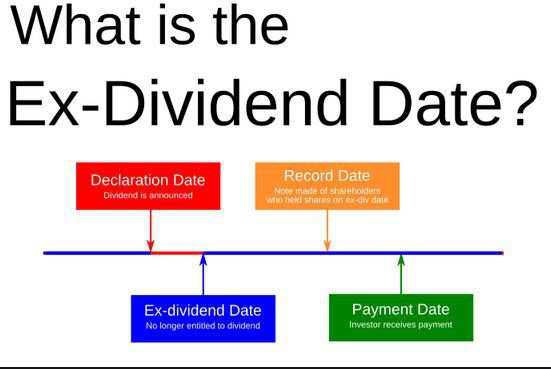

You need to check in on the status of your account on two important dates to determine if you are entitled to a dividend. A "record date" is the date you must be listed as a shareholder on the business's books to be eligible for the dividend when it is announced by a corporation that pays dividends. Businesses also utilise this data to ascertain who will get proxy statements, financial reports, and other types of information.

The Dividend Effect

A dividend is a share of a company's profits given to a group of shareholders in cash, stock, or other property. It is a share of the company's profits and a reward to its investors. Dividends are a big reason why a lot of people buy stocks. Long-term investors want to keep their stocks for a long time, and dividends can help them make more money. An increasing dividend payout may indicate that business is booming. That's why stock prices can go up right after dividends are announced.

However, the stock price must drop on the ex-dividend day. About the same amount as the dividends distributed will be deducted from the stock's value. The money removed from the books has been included in the current market price. You need to examine and comprehend all dates in a dividend schedule to determine the ex-dividend date.

1. Dividend Declaration Date

The day a corporation officially announces that it will distribute dividends is known as the "dividend declaration date." Typically, the corporation will issue a press release and announce the development on its website.

2. Date of Record

The next significant date is the date of record. During this step, the company records each shareholder who owns shares and is eligible to receive dividend payments.

3. Dividend Payment Date

Finally, dividends are distributed to shareholders on the dividend payment date. In most circumstances, the money will be deposited into the shareholder's brokerage or checking account, while in others, a check will be mailed to them.

Wait for a Dividend or Sell Now?

Getting a dividend may be counterproductive financially. To get a dividend, you must wait to sell your shares until after the ex-dividend date. The dividend amount is reflected in a price drop on the Ex-Dividend date. A decline in share price greater than the dividend is possible, but any change in share price above the dividend amount would have occurred in any case. As expected, most Australian stocks would likely rise today if the US markets had gained 1% overnight. Even if the price of a stock doesn't fall on the day it goes ex-dividend, it can rise if the dividend weren't distributed on that day. As a result, "other things being equal," the price did drop. Most shareholders should not sell their shares until they get a dividend. There are some minor tax considerations to keep in mind, but this won't have much of an impact on most individuals.

How To Determine If An Ex-Dividend Date Is Appropriate For Your Investment Strategy

Buying a dividend stock shortly before it pays a dividend, keeping it long enough to collect the payout and then selling it is a common "dividend capture" trading technique. You have "caught" the dividend for free, other than the transaction cost, if you can sell it for the same amount you acquired it for, which is not always a sure thing.

That's why it's important to buy shares of stock before the ex-dividend date. You would then be eligible to receive the dividend as a shareholder of record as of the record date on which the dividend is paid. The dividend amount discounts the stock price on the ex-dividend date. Following this, you should wait for the stock price to recover to where it was before the ex-dividend date, as this is the next step in the process. At this time, you sell the stock to go back to where you started.

Dealers and brokers in securities who engage in high volumes of low-cost deals may find dividend capture schemes appealing. Corporations may potentially be eligible for tax incentives. Unfortunately, the typical investor does not have a high chance of profiting.

Conclusion

Companies often distribute dividends to their stockholders as a means of spreading wealth. In most cases, the dividend yield is reflected in a price decline for the stock when it is distributed. The market adjusts the price of a stock to reflect the earnings it generates for shareholders.