Introduction

A loan or investment with simple interest is charged at a flat rate that is applied just to the principal amount outstanding. This interest computation approach is straightforward. Simple interest applies to saving, borrowing, and investing, but it's most effective when borrowing because it reduces debt building. This includes auto loans, installment loans, unsecured personal loans, and even some types of home mortgages. In a loan with simple interest, the principal and interest for the first month are included in the first payment. Unlike compound interest, unpaid interest does not build up from one month to the next.

You can also invest and develop your money with the help of simple interest. Principal interest refers to the interest earned on the initial principal amount only. Regularly, but without accrual, simple interest is paid to investors. In exchange for making your funds accessible for the bank to lend out, you can earn a monthly interest income using this rate structure on savings accounts or CDs.

Application Of Simple Interest In Real Life

Auto Loans

Automobile loans have a monthly amortization that allocates a portion of the loan to pay off the principal balance. With the remaining funds, interest is paid. More of each monthly payment can be applied to the principal as interest payments decline in tandem with the outstanding balance.

For example, Mar has a $4,000 auto loan with a $30,000 interest balance. With a 60-month loan period (far within the allowed five years), the monthly cost comes to $552.50. Interest for the initial month is currently set at $100. It amounts to a principal payoff of $452.50. The principal sum is $29,547.50 at the end of the first month, and $100 interest is due. If the loan is paid back in full and on time every month, no balance will be left over at the end of the 60th month.

Deposit Certificates

For this purpose, we will focus on CDs with terms of no more than one year. Here's an example: Dan invests $100,000 in a certificate of deposit with a year's maturity and a 3% yearly interest rate. He could expect to earn $2,000 in interest after a year. Even if the interest rate remains the same for the first six months, he will still receive $1,500.

Loans for Consumers (and Others)

Malls regularly sell some appliances at simple interest rates for up to 12 months (or 24 months in other circumstances) (or 24 months in some cases). At an annual rate of 8%, the monthly payment on a $3,000 microwave oven would be $270. If you were to buy a microwave every month for a year, it would cost you $3,240.

Reduced Prices for Early Payments

When customers pay their invoices ahead of time, suppliers often give them a discount. Take company XYZ, for example; they provide a 0.10% discount to any business that pays its bills within a month of being due. If ABC Company pays its invoice of $150,000 by the due date, it will receive a discount of 0.10%, or $15,000.

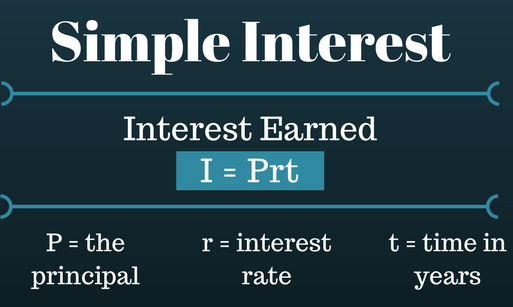

How To Calculate Simple Interest?

Debtors who make early or prompt monthly payments against the principal balance of their loans benefit the most from simple interest because it is typically computed daily. Because of this, principal payments can be reduced, and the loan can be repaid sooner than expected.

However, if you pay your loan late each month, a higher payment will go toward the interest on the loan. If you fail to make principal payments at the projected rate, you will owe more money on the loan than planned. Debtors who make early or prompt monthly payments against the principal balance of their loans benefit the most from simple interest because it is typically computed daily. Because of this, principal payments can be reduced, and the loan can be repaid sooner than expected. However, if you are consistently late with your loan payments, a more significant percentage of your payment will be applied to interest. When principal payments are not made at the estimated rate, the overall cost of the loan ends up being more than was initially anticipated.

Conclusion

Since simple interest doesn't add to itself as compound interest does, it typically has a lower impact on the borrower's bottom line. To put it another way, investors lose money with simple interest since it does not account for compound interest, which can increase profits. Loan agreements should always favor compounded interest for investors, while vital interest should be preferred for borrowers.